- What's New

- Pricing & Purchasing

- Lead Times

- Literature & Samples

- Services & Warranties

- Careers

- Find a Rep

KI Now 100% Owned by Employees; Resch Calls it 'A New Era' for Company

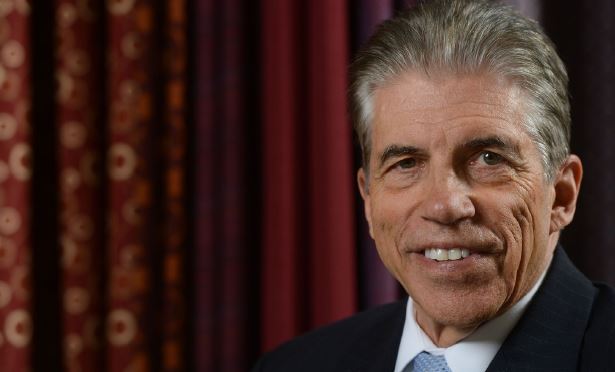

KI could have sold out to any number of suitors, including those in the industry, an investment company or conglomerate, but Chief Executive Officer Dick Resch said it was important to him that ownership remain with its employees through an Employee Stock Ownership Plan or ESOP.

By Rob Kirkbride

KI completed the move to become a 100 percent employee-owned company late last week, a shift that should keep the company solidly independent and keep it in Green Bay for the long term.

KI could have sold out to any number of suitors, including those in the industry, an investment company or conglomerate, but Chief Executive Officer Dick Resch said it was important to him that ownership remain with its employees through an Employee Stock Ownership Plan or ESOP. He called it the beginning of a new era for KI.

"The goal was to transfer ownership to all employees, keep the company in Green Bay and support the greater community that we are in," he said.

Employees were notified of the change during a town hall meeting yesterday at its headquarters in Green Bay. Resch told surprised employees, "Effective last Friday, April 27, KI completed its transition to 100 percent employee ownership through its Employee Stock Ownership Plan or ESOP. Simply stated, you now own the company, 100 percent of it. This is truly a historic moment in the history of the company."

KI completed the move to become a 100 percent employee-owned company late last week, a shift that should keep the company solidly independent and keep it in Green Bay for the long term.

KI could have sold out to any number of suitors, including those in the industry, an investment company or conglomerate, but Chief Executive Officer Dick Resch said it was important to him that ownership remain with its employees through an Employee Stock Ownership Plan or ESOP. He called it the beginning of a new era for KI.

"The goal was to transfer ownership to all employees, keep the company in Green Bay and support the greater community that we are in," he said.

Employees were notified of the change during a town hall meeting yesterday at its headquarters in Green Bay. Resch told surprised employees, "Effective last Friday, April 27, KI completed its transition to 100 percent employee ownership through its Employee Stock Ownership Plan or ESOP. Simply stated, you now own the company, 100 percent of it. This is truly a historic moment in the history of the company."

Resch said during the meeting with employees, which was also broadcast to the company's other locations, that the ongoing success of this business rests with each of them. He said he firmly believes the ESOP structure best positions the company - and each employee - for success.

"With this whole transition, our options were very straightforward. We could have explored a sale of the business to a competitor, or to a private equity partner. Honestly, either of those options might have been easier and more expedient," he told employees at the meeting. "But neither would have protected the business that you - and past generations of KI employees - have built over the past 77 years."

"I've never been one to talk legacy, but for me this is personal. I've spent 53 years of my life committed to KI. So, yes, it's important to me that KI and Spacesaver stay in the hands of our employees, and remain independent and headquartered in Green Bay and Fort Atkinson respectively."

KI has had an ESOP in place since 2006, but prior to the transition to full employee ownership on April 27, the company was primarily owned by members of the Resch family. The KI ESOP started out with about a 7 percent share of the company. The KI ESOP grew to own about 29 percent of the company prior to the move to make it a 100 percent employee owned company last week.

The ESOP represents a stable ownership structure that will enable the company's growth over the long term, Resch said in an interview with Business of Furniture. The transformation also gives KI employees greater opportunity to take part in the benefits of stock ownership. KI has more than 2,000 employees worldwide.

Resch has always embraced entrepreneurship and the power of business ownership. Through the ESOP, he is transferring that to his employees. "We have committed employees that are owners," he said. "We all do well together and as long as we continue to do well, the retirement plan will be very substantial for each employee."

KI Chief Financial Officer Kelly Anderson said the company and the employee participants will benefit from the ESOP. As a company - since it is an S-Corp and an ESOP company - it won't have to pay federal or state taxes. Instead, employees are taxed whenever they take money out at the time of retirement. The tax savings will be socked back into the company, which should improve profitability.

"All of those individuals (who are part of the ESOP) will have some sort of impact on the company's bottom line," he said. "The primary reason for this is to create an employee ownership mentality, which KI has promoted forever. Everyone will have skin in the game and will be focused on growth, profitability and cost control. It will promote thinking like an owner."

Employees do not buy into the ESOP program at KI. Instead, they received shares through their time with the company and its profitability each year. It is part of the profit sharing program and can reach 10 percent each year. Along with the 2 percent match in the employee's 401K plan, KI is very generous with its retirement accounts.

The change to a 100 percent ESOP did not happen overnight. Resch said he has planned to do something like this for many years. Planning for the change began last August. KI is now among the 50 largest ESOP companies in the United States.

As far as the operation or structure of the company, nothing will change for employees or KI customers. Resch said he plans to stay on as CEO - for now.

"Personally, I've always enjoyed the climb more than reaching the summit," he said. "So for the foreseeable future, it will be business as usual here and I will continue in my role as CEO and chairman of the board. That said, I am working closely with our board of directors and the KI leadership team on a plan to gradually transition out of the business over the next few years."

If you are new to ESOP plans, here's how it works (though this is generic and is not meant to represent the exact details of the KI plan).

According to the National Center for Employee Ownership, an ESOP is a kind of employee benefit plan, similar in some ways to a profit-sharing plan. In an ESOP, a company sets up a trust fund, into which it contributes new shares of its own stock or cash to buy existing shares. Alternatively, the ESOP can borrow money to buy new or existing shares, with the company making cash contributions to the plan to enable it to repay the loan. Regardless of how the plan acquires stock, company contributions to the trust are tax-deductible, within certain limits. The 2017 tax bill limits net interest deductions for businesses to 30% of EBITDA (earnings before interest, taxes, depreciation, and amortization) for four years, at which point the limit decreases to 30% of EBIT (not EBITDA). In other words, starting in 2022, business will subtract depreciation and amortization from their earnings before calculating their maximum deductible interest payments.

Shares in the trust are allocated to individual employee accounts. Although there are some exceptions, generally all full-time employees over 21 participate in the plan. Allocations are made either on the basis of relative pay or some more equal formula. As employees accumulate seniority with the company, they acquire an increasing right to the shares in their account, a process known as vesting. Employees must be 100% vested within three to six years, depending on whether vesting is all at once (cliff vesting) or gradual.

When employees leave the company, they receive their stock, which the company must buy back from them at its fair market value (unless there is a public market for the shares). Private companies must have an annual outside valuation to determine the price of their shares. In private companies, employees must be able to vote their allocated shares on major issues, such as closing or relocating, but the company can choose whether to pass through voting rights (such as for the board of directors) on other issues. In public companies, employees must be able to vote all issues.